Read our latest Quarterly Newsletter here!

View More

Blog

Quarterly Insights Newsletter 2024

July 26, 2024Quarterly Insights Newsletter 2024

April 25, 2024Read our latest Quarterly Newsletter here!

View More

Quarterly Newsletter 2023 Q4

December 21, 2023Read our latest Quarterly Newsletter here!

View More

Congratulations Pam Appell!

November 8, 2023

NAPA named Pam Appell to List of Nation's Top Women Advisors!

View More

Quarterly Newsletter 2023 Q3

September 14, 2023Read our latest Quarterly Newsletter here!

View More

Quarterly Newsletter 2023 Q2

May 31, 2023Read our latest Quarterly Newsletter here!

View More

Quarterly Newsletter 2023 Q1

March 3, 2023Read our latest Quarterly Newsletter here!

View More

Quarterly Newsletter 2022 Q4

December 28, 2022Read our latest Quarterly Newsletter here!

View More

Allison Winge & Pamela Appell Named to List of Nation's Top Women Advisors

October 24, 2022

Plexus Financial Services, LLC is honored to announce Allison Winge and Pam Appell were named NAPA's 2022 Top Women Advisors in the Captains and All-Stars categories.

View More

Cybersecurity Must Be a Priority for Plan Fiduciaries

October 5, 2022401(k) accounts contain a plethora of sensitive personal information that can entice hackers interested in perpetrating identity theft and other forms of fraud. Because of these risks, it’s important for fiduciaries to understand cybersecurity and to follow established safety

View More

Quarterly Newsletter for Q3 2022

September 29, 2022Read our latest Quarterly Newsletter here!

View More

Financial Stress in the Workplace

September 14, 2022As the global economy continues to gyrate on an uncertain path, many are feeling increased stress regarding their finances. As of March, for example, total U.S. household debt was up more than 8% year over year, according to a study by NerdWallet!

View More

Top Trends in Retirement Plans

June 27, 2022A recent survey of over 100 large defined-contribution plans reflects the popularity of target-date funds, while the adoption of managed accounts seems to have stalled. The median plan in the survey had assets of $240 million and over 5,000 participants as of year-end 2021.

View More

Quarterly Newsletter for Q2 2022

June 13, 2022Read our latest Quarterly Newsletter here!

View More

DOL Audit Warning Signs

June 9, 2022Has your 401(k) plan been recently audited? If not, it may be a matter of time before the IRS or DOL will come knocking at your door!

View More

Fiduciary Liability Policies

June 8, 2022

What is the buzz around Fiduciary Liability insurance, and why do you need it? Did you know that as a Plan Fiduciary, your assets could be on the hook? Read on to find out how Fiduciary Liability insurance can help protect fiduciaries against breach of fiduciary duty claims.

View More

Plexus Financial Services Named to List of Nation's Top DC Advisor Teams

April 5, 2022

We are honored to announce that Plexus Financial Services, LLC has been named to the National Association of Plan Advisors' list of the nation's top defined contribution (DC) Advisor Teams with assets under advisement of $100 Million.

View More

Employee Education: 10 Things About Inflation

March 31, 2022After decades in hibernation, inflation’s back. Here are the basics about this invisible thief.

View More

The War on Investors' Minds

March 17, 2022Since the dawn of time, war and conflict have been with us throughout history, bringing with them their own horrors and uncertainty.

View More

Quarterly Newsletter for Q1 2022

March 3, 2022Read our latest Quarterly Newsletter here!

View More

Retirement Times Newsletter Q3 2021

December 9, 2021Read our latest Retirement Times newsletter here!

View More

Participant Corner: Online Security Tips from the Department of Labor

November 12, 2021You can reduce the risk of fraud and loss to your retirement account by following just a couple basic rules!

View More

Retirement Times Newsletter Q3 2021

September 17, 2021

Read our latest Retirement Times newsletter here!

View More

Retirement Times Newsletter Q2 2021

June 29, 2021Read our latest Retirement Times newsletter here!

View More

Retirement Times Newsletter Q1 2021

March 8, 2021Plexus Financial Services, LLC releases their Retirement Times quarterly newsletter for Q1 of 2021.

View More

Should You Adopt a Plan Committee Charter?

February 3, 2021The primary purpose of a committee charter is to document overall plan governance. It is not dissimilar to how your Investment Policy Statement (IPS) acts as a “roadmap” for managing your plan investments. The charter also documents delegation of fiduciary responsibilities from the plan’s “named fiduciary” to co-fiduciaries.

View More

Annual Plan Audit: An Auditor’s Perspective

January 27, 2021This article identifies auditors concerns in areas of plan management that may lead to plan fiduciary exposure to litigation and regulatory breaches.

View More

Are You Hearing About Financial Wellness?

January 20, 2021A financial wellness program can improve employee productivity, increase employee satisfaction, reduce absenteeism and even help cut down on stress related health care claims.

View More

To Roth or Not to Roth

January 6, 2021Uncertain about benefits of allocating contributions to traditional vs Roth options? Check out this article to learn more!

View More

Four Tips for Increasing Your Retirement Dollars

December 18, 2020

Check out a few tips that can help increase your retirement dollars!

View More

Participant Corner: Budgeting for Retirement

December 16, 2020There are all kinds of “rule of thumb” numbers floating around for how much income you’ll need in retirement, but they are just that — guidelines, not hard and fast rules that will necessarily apply to your particular situation. Budgeting for your retirement is a bit of a guessing game however clarifying your goals and expectations will make it easier!

View More

Beware of the IRS and DOL: Four Red Flags They Seek on Form 5500

December 2, 2020Make sure your company is compliant by being aware of what the IRS and DOL look for on Form 5500 filings!

View More

Visualize Retirement – What Are Your Participants Saving For?

December 2, 2020How can an employee know how much money they’re going to need in retirement if they don’t know what they’re saving for?

View More

Retirement Times Newsletter Fall 2020

November 24, 2020Plexus Financial Services, LLC releases their Retirement Times quarterly newsletter for Fall 2020.

View More

What Constitutes Proper Documentation of Retirement Plan Committee Meetings?

November 11, 2020With most retirement plans, the fiduciary responsibility of selecting and monitoring the plan’s menu of investments is designated to a retirement plan investment committee. Decisions are made during committee meetings and from a fiduciary perspective it is just as important to properly document these meetings as it is to hold them!

View More

Are Your Participants Experiencing a Fee Imbalance?

October 27, 2020Subsequent to the 2012 implementation of ERISA fee reporting regulations (ERISA 408(b)(2) & 404(a)(5)), the Department of Labor (DOL) began to consider the appropriateness of the allocation of plan fees among participants.

View More

Top Ten Fiduciary Responsibilities

October 15, 2020Fiduciaries identify and serve the best interests of a retirement plan’s participants and beneficiaries. Here are 10 important responsibilities to keep in mind.

View More

Cybersecurity and Your Retirement Plan – Are Your Participants at Risk?

October 14, 2020Plan administrators should implement measures to protect PII and their participants from cyber attacks wherever possible.

View More

Is it Time for a Plan Refresh?

September 23, 2020According to a 2016 JP Morgan survey¹ nearly 75 percent of participants say they are not confident with selecting investments. The duty to provide participants with sufficient information to make consistently informed retirement investment decisions is a basic fiduciary responsibility under ERISA Section 404(a).

View More

Plan Documents… Save or Purge?

September 16, 2020Most plan sponsors adopt an assumed “reasonable” amount of time to retain documents prior to purging them. Unfortunately, IRS rules may not always be complicit with what may be assumed to be “reasonable”

View More

Election Year Investment Volatility

September 16, 2020Election years, with their uncertainty and increased emotions, cause anxiety for investors. Certainly, there may be short-term market volatility around elections, but what does history suggest?

View More

Participant Corner: Retirement Plan Check-Up

September 9, 2020Encourage your employees to conduct a regular examination of their retirement plan to determine whether any changes need to be made. This is a vital practice that can get your employees closer to meeting their retirement goals!

View More

Ten Reasons to Roll Over Into Your Plan Versus an IRA

August 31, 2020Do you have employees in a prior employer’s retirement plan? Are they wondering if they should transfer these assets to a personal IRA or into your employer-sponsored retirement plan? Review these pros and cons of an individual retirement account (IRA) versus consolidating into the current retirement plan with your employees to help them make this decision.

View More

Should your Company Implement a Student Loan Assistance Program?

August 31, 202026% of the U.S. workforce and 69% of 2018 college graduates are encumbered by student loans, with the national student loan debt total climbing steadily towards $1.6T! Should you implement a student loan assistance program? Read on to learn how you can help your current employees and attract new talent.

View More

It’s That Time Again! Back-to-School for Fiduciaries

August 19, 2020Can you hear the bells ringing? It’s that time of year to review your to-do list of fiduciary responsibilities. Ask yourself these 15 questions to make sure you are on top of these priorities!

View More

Keeping in Compliance: IRS Tips for Plan Sponsors

August 19, 2020As an employer, you’re responsible for keeping your company’s retirement plan in compliance at all times - but is your plan document reviewed on an annual basis?

View More

Effective Employee Education

August 19, 2020It’s not always easy to know what your participants need, want or will take advantage of. Using a simple framework for your educational program may increase its effectiveness!

View More

Four Ways to Increase Employee Retirement Contribution Participation

July 28, 2020How can you encourage your employees to save and save more? Get prepared with these helpful tips!

View More

Retirement Times Newsletter Summer 2020

July 24, 2020Plexus Financial Services, LLC releases their Retirement Times quarterly newsletter for Summer 2020.

View More

Are You Ready for an Audit?

July 15, 2020Oftentimes an audit is a random event, which is why you should always be prepared. Here are some items that should be readily accessible by the plan administrator at all times the plan is in operation.

View More

The Evolving Workscape

July 8, 2020Modern workers have new priorities. How can you keep them satisfied in the workplace? Adapt to the shifting priorities of modern workers to attract and retain the best talent!

View More

Summer Homework for Fiduciaries

July 1, 2020As you bask in the glory of summer over the next couple of months, don’t forget the three Fs that define this cherished season — fun, Fourth of July, and fiduciary! While you’re enjoying the fruits of summer, don’t forget your fiduciary responsibilities! Ask yourself the following 15 questions to make sure you are on top of your responsibilities and liabilities.

View More

Are You Reducing Your Debt?

June 17, 2020You’ve heard the phrase, “Slow and steady wins the race.” The same is true when it comes to reducing debt. If debt is a leading contributor to your overall stress, you’re not alone! Read on for a straightforward four-step method to help you reduce your debt.

View More

How Long Will Your Money Last?

June 10, 2020

The big question when it comes to retirement is, “How much money am I going to need?” With all of the advanced education and strategy tools available, it is still often difficult to understand the difference between what you can save for retirement and what is needed to retire.

View More

Six Easy Steps to Keep Your Plan Assets Safe

June 2, 2020

Cyber fraud is a growing concern globally. Individuals are typically very careful to keep their bank account and email authentication information safe, but they aren’t always smart with the rest of their personal information.

View More

Borrowing Against Your Retirement Plan: More Costly Than You Think

May 26, 2020

Borrowing Against Your Retirement Plan: More Costly Than You Think! Participating in the company's retirement plan is a smart (and important) decision. Smart because you are putting away small amounts today for a comfortable retirement later. As your account begins to grow, it may be tempting to dip into your retirement savings by taking a loan against your retirement plan to pay your annual taxes, repair a leaking roof, catch up on your everyday pile of bills and so on...

View More

Health Modification Can Increase Retirement Dollars

April 29, 2020

A top concern for individuals nearing retirement is out-of-pocket healthcare costs. A recent survey revealed that 74 percent (of 1,316 U.S. adults aged 50 or older) admit that one of their top fears is out-of-control healthcare costs, and 64 percent are terrified of what healthcare costs may do to their retirement plans (up from 57 percent in 2015).¹ Although the fear is clearly real, there is something people can do mitigate future healthcare costs.

View More

Participant Communication: Tips to Follow During a Turbulent Market

March 16, 2020With the recent market volatility, it’s understandable that you may be concerned about your investments. Don’t be discouraged and most of all, don’t panic. Instead, be proactive!

View More

Retirement Times Newsletter Winter 2020

March 13, 2020Plexus Financial Services, LLC releases their Retirement Times Quarterly Newsletter for Winter 2020.

View More

Retirement Times Newsletter Fall 2019

October 4, 2019Plexus Financial Services, LLC releases their Retirement Times Quarterly Newsletter for Fall 2019.

View More

Retirement Times Newsletter Summer 2019

August 1, 2019Plexus Financial Services, LLC releases their Retirement Times Quarterly Newsletter for Summer 2019.

View More

PFS Executive VP Allison Winge To Present at PSCA National Conference

April 30, 2019

Plexus Financial Services, LLC Executive Vice President Allison Winge will present "Mind Over Money" at the annual national Plan Sponsor Council of America (PSCA) Wednesday, May 1, 2019 in Tampa.

View More

CHAMPIONING WEALTH

April 26, 2019

MANNING MANIA: Plexus Financial Services, LLC executives Allison Winge, Pamela Appell and Keith Hamann met Peyton Manning at the 2019 National Association of Plan Advisors (NAPA) 401(k) Summit in Las Vegas this month. PFS champions customized financial solutions for each client.

View More

Retirement Times Newsletter Spring 2019

April 24, 2019Plexus Financial Services, LLC releases the Retirement Times Newsletter for Spring 2019.

View More

PLEXUS FINANCIAL SERVICES, LLC Offers Internship

February 18, 2019

Plexus Financial Services, LLC is offering a paid internship this summer for college students want to learning about financial advising and retirement planning.

View More

Retirement Times Newsletter: Winter 2019

February 5, 2019Plexus Financial Services, LLC Retirement Times Winter 2019 Newsletter is news you can use for planning a worry-free post-work life.

View More

PLEXUS FINANCIAL SERVICES NEWSFLASH: Evaluate Your Retirement Plan’s Analytics

February 5, 2019

Use Plan Analytics to Evaluate Your Retirement Plan --Your retirement plan is a valuable resource for your employees and serves as a vehicle to attract and retain top talent. Ensuring plan success is crucial. Examining plan analytics can help evaluate its success.

View More

NAPA Names Pamela Appell to List of 2018 Top Woman Advisors

December 5, 2018

The National Association of Plan Advisors (NAPA) recently named Plexus Financial Services, LLC’s Vice President of Client Relations Pamela Appell to its list of 2018 Top Women Advisors.

View More

PFS Participant Education: Financial Planning Basics - Part 3

November 2, 2018

Do you picture yourself owning a new home, starting a business, or retiring comfortably? These are a few of the financial goals that may be important to you, and each comes with a price tag attached. That's where financial planning comes in.

View More

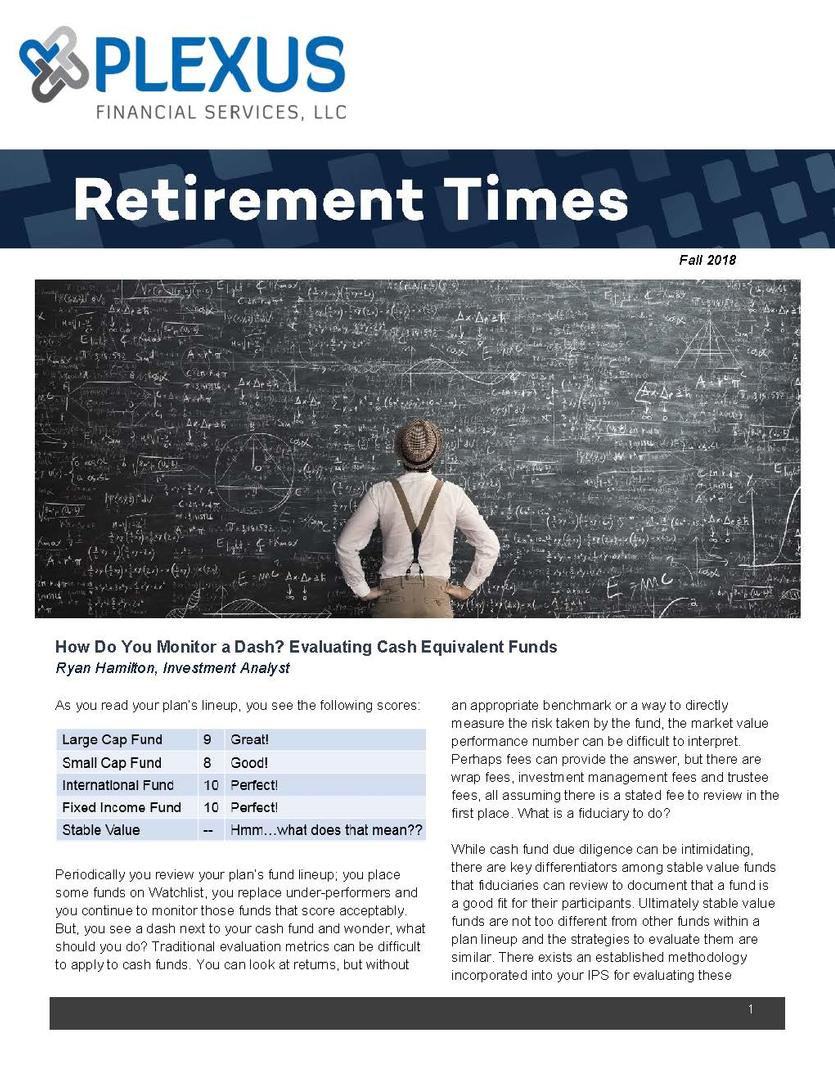

Retirement Times Newsletter Fall 2018

October 23, 2018

Plexus Financial Services, LLC Retirement Times Newsletter is news you can use for planning a worry-free post-work life.

View More

PFS Participant Education: Financial Planning Basics - Part 2

October 19, 2018

Test Your Knowledge of Financial Basics How well do you understand personal finance? The following brief quiz can help you gauge your knowledge of a few basics.

View More

PFS Participant Education: Financial Planning Basics - Part 1

October 19, 2018~001.png)

Watch our video about Financial Planning Basics!

View More

PFS Participant Education: Investment Basics -- Part 3

August 3, 2018

Plexus Financial Services, LLC announces the third installment in its Participant Education series about Investment Basics.

View More

PRESS RELEASE: PFS Leaders Named As Delegates to NAPA DC Fly-In Forum

July 27, 2018Practice Leader Allison Winge and Vice President, Client Relations Pamela Appell of Plexus Financial Services, LLC recently participated as delegates to the National Association of Plan Advisors (NAPA) Annual DC Fly-In Forum, an exclusive gathering of the nation’s leading retirement plan advisors.

View More

PFS Leaders Meet State Representative Roskam

July 26, 2018

Plexus Financial Services, LLC Practice Leader Allison Winge and Vice President, Client Relations Pamela Appell met with Illinois State Representative Peter Roskam, a Republican representing the 6th District.

View More

PFS Participates In NAPA FLY-IN FORUM

July 24, 2018Plexus Financial Services, LLC is participating this week in the NAPA FLY-IN FORUM in D.C.

View More

PFS Participant Education: Investment Basics - Part 2

July 19, 2018

Plexus Financial Services, LLC releases the second part of Participant Education about Investment Basics.

View More

Retirement Times Newsletter Summer 2018

July 19, 2018Plexus Financial Services, LLC Summer 2018 Retirement Times Newsletter delves into the latest retirement news and trends.

View More

Allison Winge Attends Institutional Investors Seminar

July 17, 2018

Executive Vice President Allison Winge of Plexus Financial Services, LLC is attending Retirement Plan Advisor Summit.

View More

PLEXUS FINANCIAL SERVICES, LLC PARTICIPATES IN PIMCO SURVEY

July 17, 2018

Plexus Financial Services, LLC, retirement advisory firm serving clients across the nation, recently participated in the renowned PIMCO 2018 Defined Contribution Consultancy Survey.

View More